How to Become a filer in Pakistan (Guide)

Many people do not know how to become filer in Pakistan? Out of 10, only 2 are tax filers which shows the number of taxpayers all over Pakistan. And as far as our Gross domestic product tax ratios are concerned those are also extremely low. With higher GDP comes higher governmental tax increase. In a country of over 222 million population, the number of active taxpayers is decreasing and that’s why the federal board of revenue (FBR) has the actual right to increase tax margin ratios.

Moreover, a filer is a person who gives taxes and is countered in ATL (Active taxpayer list), and on the other hand, a non-filer person is someone who is not registered in FBR and doesn’t give governmental taxes.

how to become filer in Pakistan and sign up for NTN (National Tax Number) from FBR?

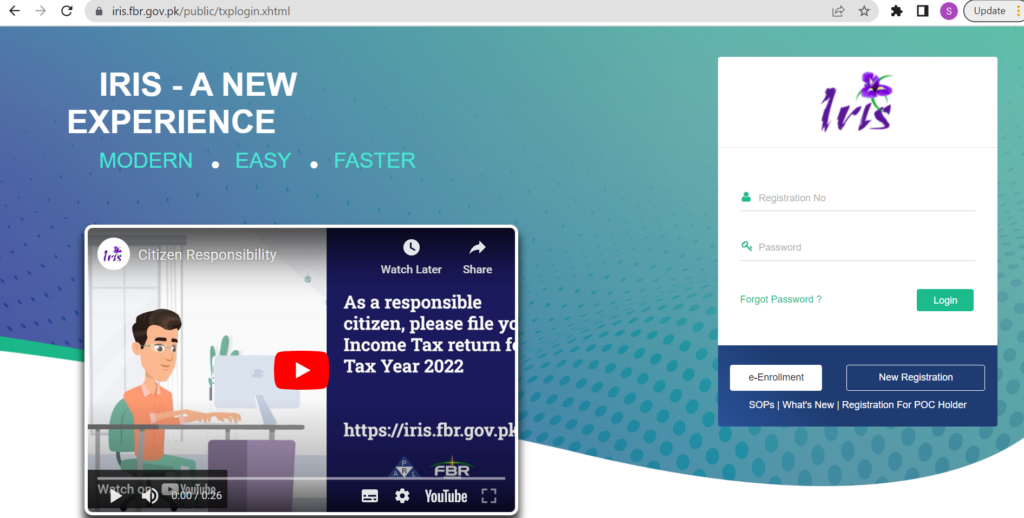

- Open FBR portal

- Now click on New registration underneath Login credentials.

- Now fill in all your relevant information including your CNIC, house address, name, age, and gender.

- Once you’re done with the information filling step click on proceed and you will get a Code via email or SMS

- Enter the code in the given box and submit! Voila, your account will be created.

- Now login with your account and you will find FBR sending you your user and password, right next you will see a 181 application form.

- Click on the edit button and enter NTN details and attach all the relevant documents asked.

- Now you will get an NTN from FBR in a little time.

Advantages of being a filer

Ready for the perks given by the Pakistani government for being a filer?

- Get a 50% payment discount while paying your vehicle token tax.

- Pay a 0.3% withholding tax on every transaction of more than 50,000. While nonfilers pay 0.4.

- Pay 50% less tax on property.

Due to all respect if your annual income is more than 6 lacs then you are eligible as a tax filer. But you can still be a filer and pay no tax, it will still accommodate you with multiple advantages.

Important paperwork required for NTN

- You must be needing a CNIC

- Electricity bill

- Payslip

- Valid contact numbers

- Valid email and NTN number

Check ATL (Active Tax list) through SMS

Follow the simple steps given below,

- You have to type ATL (space) 13 digits CNIC number and send it to 9966

- For company ATL checking, type ATL (space) 7 digits NTN and send it to 9966

Conclusion

Be a responsible citizen and pay your taxes on time every year!

Also Read: Best Dispenser in Pakistan | Best Microwave Oven | Best LED TV in Pakistan | Best Mattress in Pakistan | Best Electric Stove in Pakistan | Best Duvet in Pakistan | Best Roti Maker in Pakistan | 11.11 vouchers | Review and Earn | Daraz Club | Daraz Bank Discounts | Daraz Bazaar | How to make easypaisa account